Delve into the Indian stock market’s reaction to exit polls, with the Nifty50 surging 3.41% in anticipation of a Modi-led victory. Gain insights into investor sentiment and strategic implications amidst heightened market optimism.

Table of Contents

Anticipated Indian Stock Market Rally, Post-Exit Polls

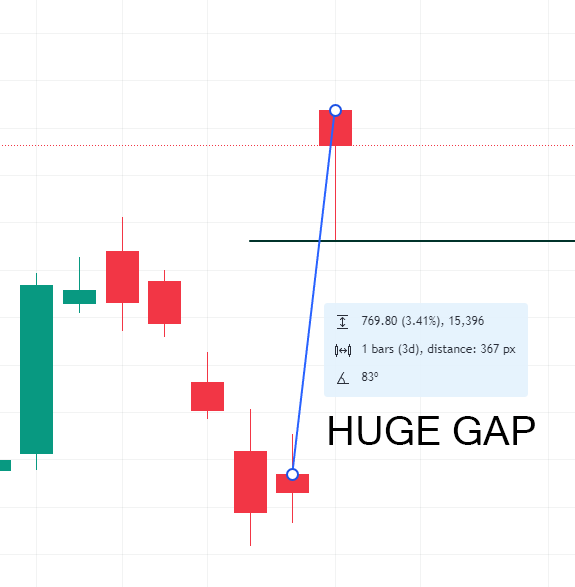

The Indian stock market is on the brink of a substantial surge following the release of Exit Polls, signaling a resounding victory for the National Democratic Alliance (NDA) led by Prime Minister Narendra Modi. The exit polls, unveiled on the evening of June 1, 2024, after the final phase of voting, indicate a decisive majority of over 350 seats for the NDA. This revelation has ignited a wave of optimism among investors, with the stock market poised to open significantly higher on Monday, June 3, 2024. The anticipated ascent of approximately 769.80 points, or 3.41%, marks one of the most substantial market upswings since the onset of the COVID-19 pandemic.

For official live updates on the election results, investors can visit the Election Commission of India’s website.

Market Dynamics and Investor Sentiment

Investor sentiment is buoyed by the prospect of political stability and continuity under Modi’s leadership, which is perceived as favorable for Economic reforms and Business Growth. Historically, a stable Government with a clear majority is seen as a positive signal for the market, leading to increased investor confidence and a surge in stock prices.

On Friday, the market closed at 22,530 points. With the expected opening at 23,337 points on Monday, there is a notable Gap-Up, which is when the market opens significantly higher than its previous closing. This gap-up is a direct response to the Exit Polls and reflects the market’s optimistic outlook on the election results.

The Technical Perspective: Trend Analysis

From a technical analysis standpoint, the Indian Stock Market has been in a clear uptrend, characterized by higher highs and higher lows. However, the recent gap-up has pushed the market to the top of the trend line, raising questions about the sustainability of this surge.

Key Points from the Technical Analysis:

Previous Trend Line Behavior: Prior to Friday, the market was trading below the trend line, indicating a period of consolidation or correction.

Gap-Up Opening: The significant gap-up on Monday pushes the market to the upper end of the trend line, which can be a resistance point.

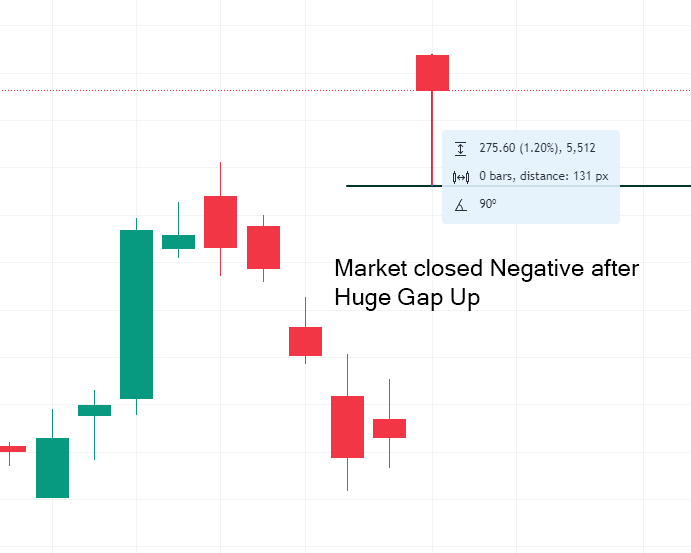

Potential for Gap Filling: Markets often tend to fill gaps, meaning the current surge might see a pullback to previous levels to complete pending orders.

Strategic Recommendations for Investors

Given the current market dynamics and the technical indicators, it is crucial for investors to approach the market with caution. While the exit polls indicate a positive outlook, it is essential to consider the following factors before making investment decisions:

Avoid Overtrading: The substantial gap-up suggests a high level of volatility. Overtrading in such conditions can lead to significant losses. It is advisable to avoid aggressive buying or selling until the market stabilizes.

Wait for Gap Filling: The market is likely to undergo a period of consolidation where it will attempt to fill the gap created by the Monday surge. This could occur over a few trading sessions. Investors should wait for this gap filling to complete before making new investment decisions.

Election Results Impact: The final election results, expected to be announced soon, will provide a clearer picture of the political landscape. It is prudent to wait for these results to be confirmed before making major investment moves.

Historical Context and Market Behavior

The Indian stock market has a history of reacting strongly to political events. For instance, during the 2014 and 2019 general elections, the market experienced significant movements in response to the election outcomes. The 2014 victory of Narendra Modi saw a bullish market trend as investors anticipated economic reforms and pro-business policies. Similarly, the 2019 re-election of Modi led to another surge in the market.

This pattern suggests that the market tends to favor political stability and decisive mandates. However, it is essential to balance this optimism with a thorough analysis of market trends and technical indicators.

Fundamental Analysis: Economic Indicators

In addition to technical analysis, investors should also consider fundamental factors that could impact the market. These include:

- Economic Growth Projections: The anticipated continuation of Modi’s economic policies could lead to improved growth projections for India. Investors should look at GDP growth rates, industrial production, and other economic indicators.

- Corporate Earnings: The performance of Indian companies, particularly in key sectors like IT, finance, and consumer goods, will play a crucial role in sustaining the market rally. Positive earnings reports can provide further support to the market.

- Global Economic Environment: The global economic landscape, including factors like US Federal Reserve policies, global trade tensions, and oil prices, can influence the Indian market. A favorable global environment can boost investor confidence.

Psychological Factors and Market Sentiment

Investor behavior can greatly influence market trends. The exit poll results have created a wave of euphoria, leading to a surge in buying activity. However, it is essential to remain cautious and avoid getting swept up in the market frenzy.

- Herd Mentality: Investors should be wary of following the crowd without conducting their own analysis. This can lead to irrational buying and selling, resulting in increased volatility.

- Fear of Missing Out (FOMO): The fear of missing out on potential gains can drive investors to make impulsive decisions. It is important to stick to a well-thought-out investment strategy and avoid making decisions based on short-term market movements.

Long-Term Investment Strategy

For long-term investors, the current market conditions provide an opportunity to review and adjust their investment strategies. Key considerations include:

- Diversification: Spreading investments across different sectors and asset classes can help mitigate risks and provide more stable returns.

- Fundamentally Strong Stocks: Focusing on companies with strong fundamentals, such as robust earnings, good management, and competitive advantages, can lead to better long-term returns.

- Regular Review: Periodic review of the investment portfolio is essential to ensure alignment with financial goals and market conditions. Investors should be prepared to make adjustments based on changing market dynamics.

Read our previous article on: Is Another Financial Crisis Looming? Explore 4 Strategies for insights on how to analyze and learn strategies.

Conclusion: Navigating the Post-Election Market

The Indian stock market’s anticipated surge following the exit poll results presents both opportunities and risks for investors. While the optimism surrounding Modi’s likely third term as Prime Minister has boosted market sentiment, it is crucial to approach the market with a balanced perspective.

Investors should avoid aggressive trading and wait for the market to stabilize and fill the gap created by the Monday surge. Keeping an eye on the final election results and other fundamental indicators will provide a clearer direction for future investments.

For official live updates on the election results, investors can visit the Election Commission of India’s website. For the latest exit poll news and analysis, NDTV’s coverage provides comprehensive insights.

By combining technical analysis, fundamental insights, and a disciplined investment strategy, investors can navigate the post-election market with confidence and make informed decisions that align with their financial goals.

![அடடா WhatsApp லயும் வந்துருச்சு Meta AI - மக்களுக்கு இன்ப அதிர்ச்சி தந்த META [WhatsApp, Facebook, Messenger]](https://gkreview.com/wp-content/uploads/2024/06/Meta-AI-768x541.jpg)