Discover how One Card helped me overcome high-interest loans and manage my finances effectively. A personal review highlighting 7 key benefits and drawbacks of using One Card.

My Journey from Financial Struggles to Stability

My financial journey hasn’t always been smooth. I found myself trapped in a cycle of high-interest loans from various third-party apps, where hidden charges made the actual interest rate skyrocket to 48%. It was a period of significant financial stress and confusion. Then, a friend recommended One Card. Initially skeptical, I soon realized how this card could revolutionize my financial management. Here are 7 reasons why One Card transformed my financial journey.

Table of Contents

1. Struggling with High-Interest Loans

Like many, I turned to various third-party loan apps to meet my financial needs. On paper, these apps advertised an interest rate of 24%, which seemed manageable. However, the reality was starkly different. Hidden charges and additional fees pushed the effective interest rate to nearly 48%. The burden was heavy, and the lack of transparency made it challenging to navigate my finances. It felt like being trapped in quicksand—the more I tried to climb out, the deeper I sank.

2. The Turning Point: Discovering One Card

Amid this financial chaos, a friend introduced me to One Card. Given my past experiences, I approached it with caution, expecting more of the same hidden charges and high fees. To my surprise, One Card offered a refreshingly different experience. It was like finding an oasis in a desert of financial despair. I was intrigued and cautiously optimistic about the potential this card had to offer.

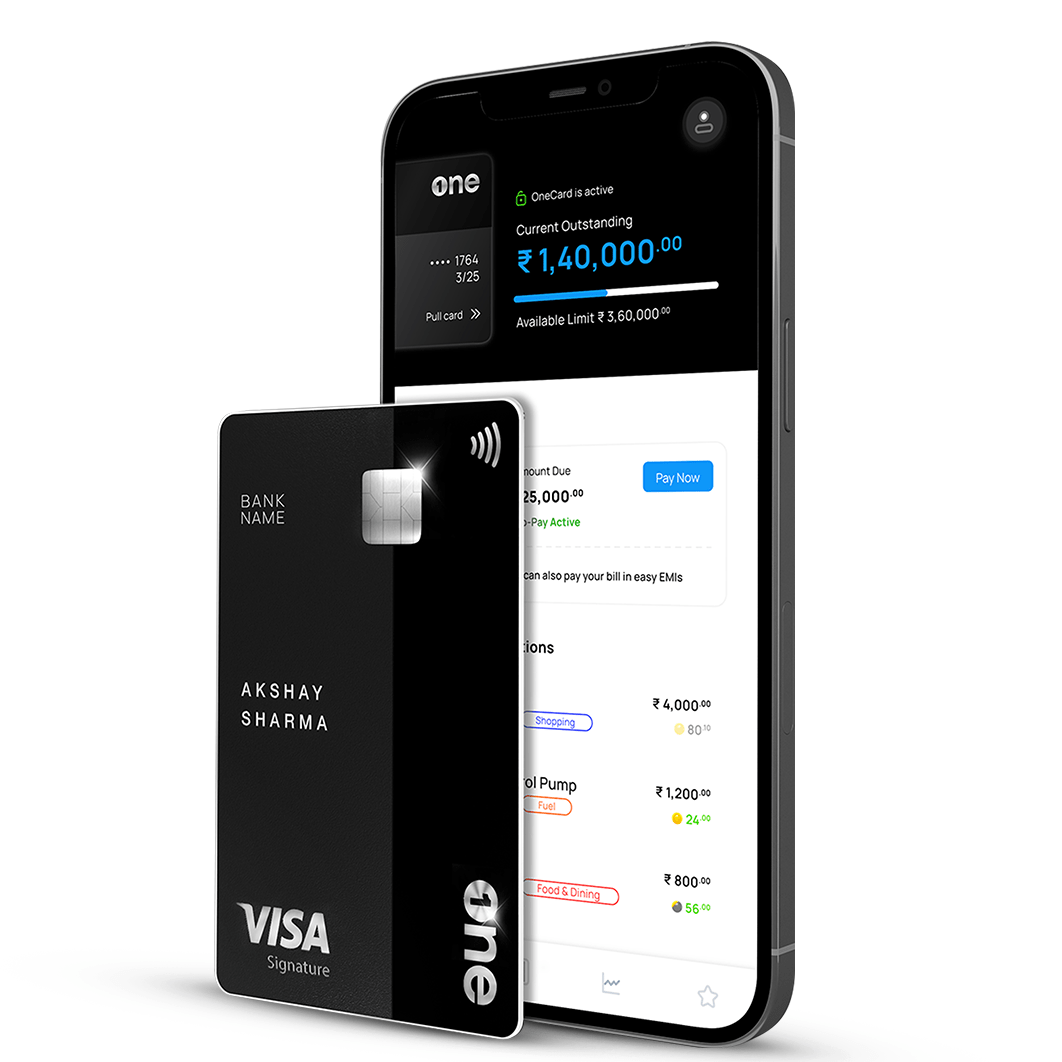

3. Paperless Onboarding: A Seamless Start

One of the first things that stood out was the paperless onboarding process. Unlike the tedious paperwork required for other financial products, getting started with One Card was incredibly simple. Within minutes, I had my account set up and ready to use. It felt like a breeze compared to the storm of documentation usually required. The convenience was akin to the simplicity of a tap on a smartphone screen.

4. Transparent Charges and Low Fees

What truly sets One Card apart is its transparency. Unlike the hidden charges that plagued my previous loan experiences, One Card has clear and straightforward fee structures. The interest rates are reasonable, and any applicable charges are communicated upfront. This level of transparency has been a breath of fresh air. Imagine finally being able to see the road clearly after driving through thick fog—One Card illuminated my financial path.

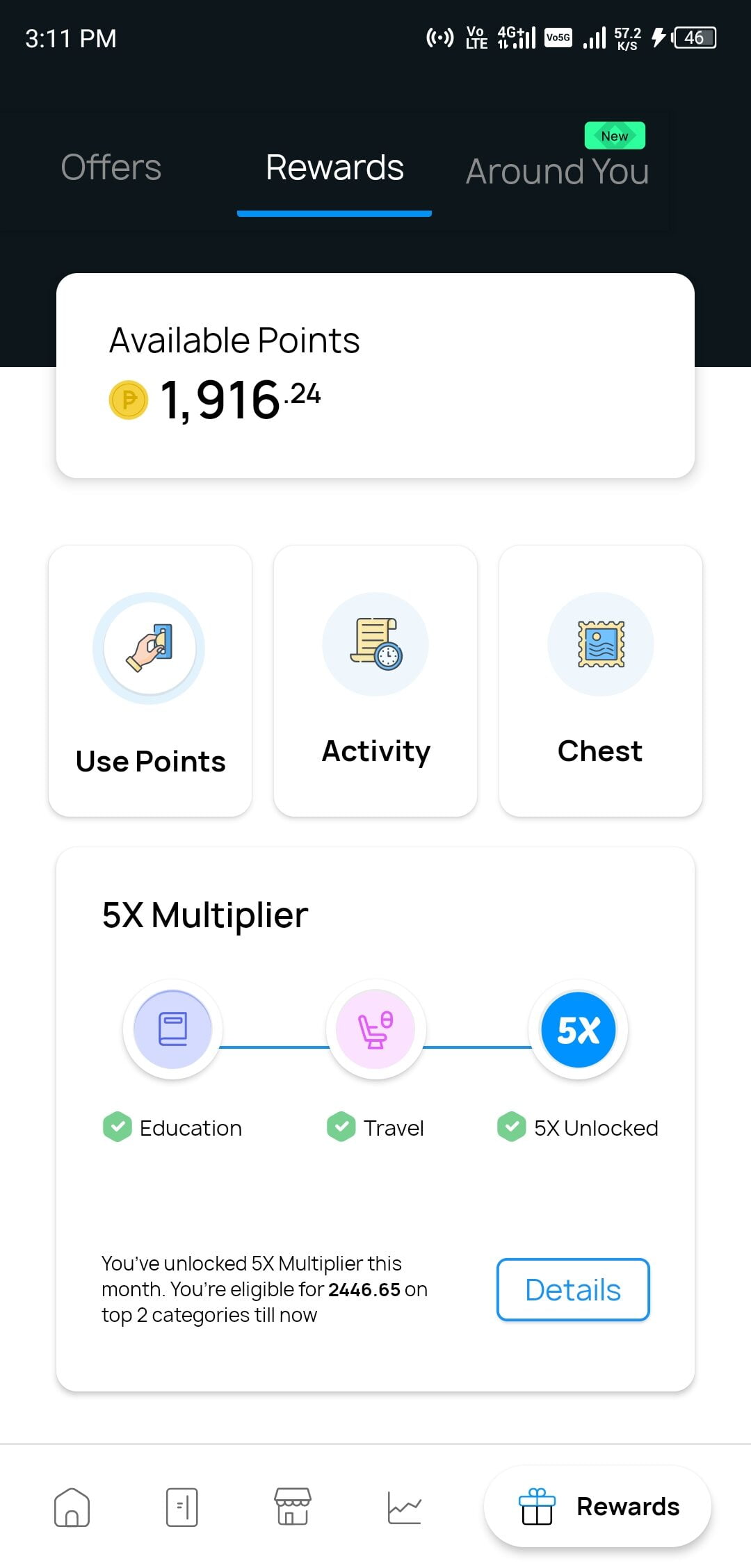

5. Maximizing Rewards: 5x Points on Every Purchase

One Card doesn’t just help you manage expenses; it rewards you for them. Each month, I earn between 300 to 400 INR in rewards, thanks to the generous 5x points system. These rewards can be redeemed in various ways, adding a valuable incentive to everyday spending. It’s like having a little financial cheerleader that applauds your every purchase. The rewards program made me look forward to my transactions, knowing I was earning something back.

6. Flexible Payment Options

Another feature that has made a significant impact is the option for partial payments. This flexibility allows me to manage my cash flow better without the pressure of paying off the entire balance at once. It’s a feature that has greatly reduced my financial stress. The freedom to make partial payments felt like breaking free from the tight grip of financial obligations, giving me room to breathe and manage my money more effectively.

7. Versatile Usage: Online and Offline

Whether I’m shopping online or making purchases in physical stores, One Card works seamlessly. Its versatility means I can rely on it for virtually all my spending needs. The only drawback I’ve encountered is that it isn’t accepted for some international purchases. However, this is a minor issue compared to the overall benefits. One Card has become my go-to payment method, a trusty companion in both the digital and physical worlds.

Additional Benefit: Choose Your Own Bill Date and Due Date

One more fantastic feature of One Card is the ability to choose your own bill date and due date. This added flexibility allows you to align your payments with your personal cash flow and financial schedule. It’s an incredible benefit that provides even more control over your finances, ensuring that your payments are made when it’s most convenient for you. This customization reduces the risk of missed payments and helps you manage your budget more effectively.

Closing Previous Cards and Loans

Since switching to One Card, I’ve closed all my previous credit cards and loan accounts. The combination of low fees, transparency, and valuable rewards made it an easy decision. I no longer have to worry about hidden charges or exorbitant interest rates. This transition felt like shedding a heavy coat on a warm day—liberating and refreshing. My financial landscape became clearer, allowing me to focus on more important aspects of life.

Referring One Card to Friends and Family

Given my positive experience, I’ve recommended One Card to all my friends and family. The benefits speak for themselves, and I’m confident it can help others just as it has helped me. Sharing this discovery felt like passing on a secret treasure map, guiding others to a more secure and rewarding financial journey. The satisfaction of helping loved ones improve their financial health added another layer of fulfillment to my own experience.

Real-Life Impact: A Better Financial Future

Using One Card has not only alleviated my immediate financial stress but also set me on a path toward a more secure financial future. The ability to manage my budget effectively, earn rewards, and avoid hidden fees has given me greater control over my finances. It’s like setting sail with a clear destination in mind, knowing the journey ahead is smoother and more predictable. The confidence and peace of mind that One Card has brought into my life are immeasurable.

Check out more consumer insights on my blog: https://gkreview.com/consumer-insights/

Conclusion

One Card has truly transformed my financial journey. From struggling with high-interest loans and hidden charges to enjoying transparent fees, generous rewards, and flexible payment options, it has been a game-changer. If you’re looking for a reliable, user-friendly credit card, I highly recommend giving One Card a try. This card has not only been a tool for financial management but a catalyst for financial growth and stability.